All but Which of the Following Are Advantages of Partnerships

Like sole proprietorship partnership form of organisation can be formed without legal formalities. E the sole proprietor incurs all losses.

Advantages And Disadvantages Of Partnership Business What Is Partnership A Plus Topper

All of the following are advantages of incorporation EXCEPT a the responsibility for the business is shared b capital is easier to raise than in other business forms c corporations face double taxation d corporations have more potential for growth.

. The owners have limited liability c. They are relatively easy to start b. More capital is available for the business.

All of the following are advantages of the partnership form of organisation except A unlimited liability. B partnerships avoid double taxation since the partnership itself is not subject to federal taxation. A are easier to form.

Which is the exceptionA. Partnerships are relatively easy to establish. B possible tax advantages.

Distributions are taxed twice similar to corporate dividend payments O b. All of the following are advantages of partnerships except one. A partnerships are relatively easy and inexpensive to establish.

A the owner has unlimited liability. Compared to sole proprietorships and partnerships a major advantage of corporations is that they. Having a partner may not only make you more productive but it may afford you the ease and flexibility to pursue more business opportunities.

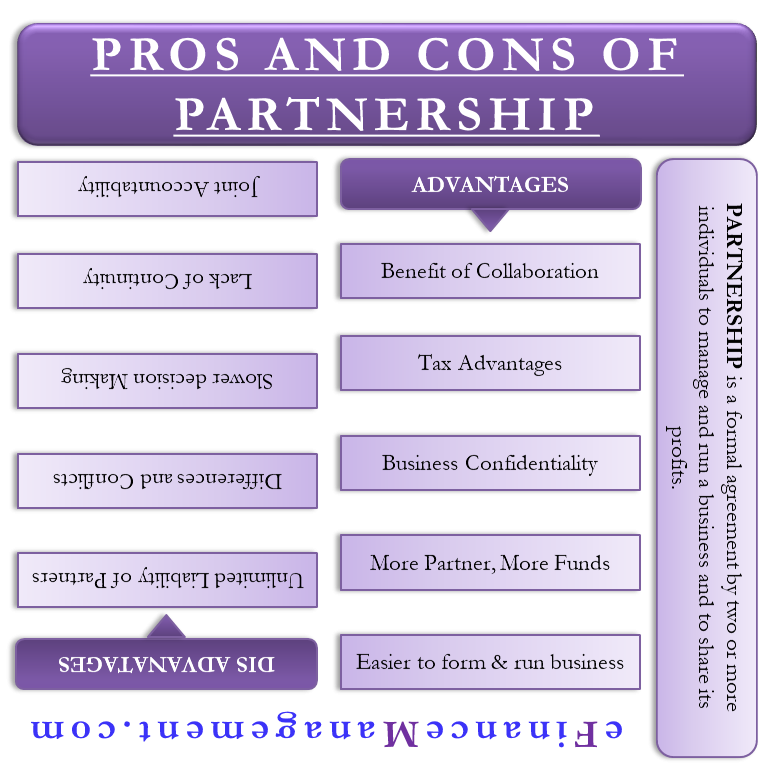

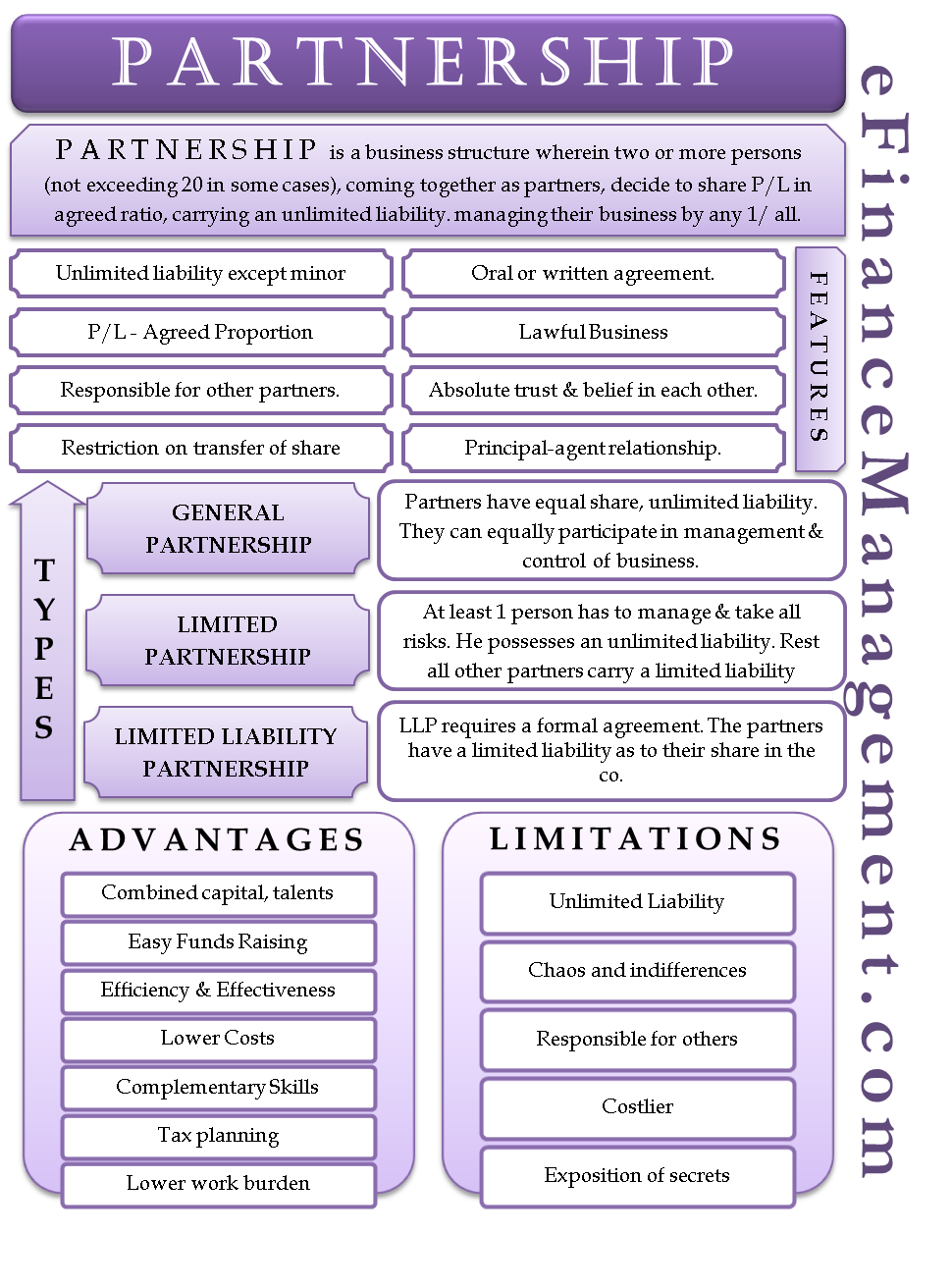

The most common alternatives are the sole trader and limited company. While partnerships enjoy certain freedoms there are disadvantages as well. Advantages of a partnership include that.

D partnerships offer the ability to combine the management and business skills of two or more people in a. Their liability is limited by each partners share of the business D. Advantages of a Partnership.

One of the advantages of having a business partner is sharing the labor. All of the following are advantages of partnership EXCEPT _____. Their profits are taxed once as personal income C.

D lack of continuity. Shared financial commitment among partners C. Easy and inexpensive to form B.

Partners retain full liability for the business. E ease of start-up. C combined skills and knowledge.

Their liability is limited by each partners share of the business d. Advantages of a partnership include all of the following except. A partnership business is one of the most common forms to run a business in the UK with several hundred partnerships currently in existence.

Ease of formation and closure The process of formation is relatively easy as the registration of the firm not compulsory. Shared experience amongst partners D. The various advantages of partnership form of organisation are stated below.

Also the closure of the business is simple and may not involve too many complexities. All of the following are considered disadvantages of sole proprietorships except. A continuation of the firm if one partner dies.

C earnings are shared. S-type corporations have all of the following advantages except Select one. Youll have greater borrowing capacity.

Your business is easy to establish and start-up costs are low. Aforming a partnership is almost as simple as establishing a sole proprietorship Bby forming a partnership there is an opportunity to share costs Cincome tax is straightforward for partnerships Dby forming a partnership there are increased chances of longevity of business. A greater opportunity for specialization by the owners E.

C partnerships have the greatest ability to accumulate capital of all of the forms of ownership. A greater opportunity for specialization by the owners e. Looked at positively the business partnership model enables you to go into business with someone else without the perceived formality of a limited.

They are relatively easy to start b. The disadvantages of a partnership highlight why selecting a trustworthy partner is vital. All of the following are advantages of a partnership except a partnerships are relatively easy and inexpensive to establish.

All of the following are advantages of partnerships except one. They are taxed as partnerships Profits are down so the controller decides to change the corporations accounting policy. C partnerships have the greatest ability to accumulate capital of all of the forms of ownership.

Partnership incentives opportunities for employees E. B retention of profits. Which is the exception.

Their liability is limited by each partners share of the business d. A greater opportunity for specialization by the owners e. Which is the exception.

In a partnership agreement the following arrangements among others should be spelled out. The shared ownership concept that characterizes a business partnership gives it certain distinct advantages and disadvantages. All of the following are advantages of partnerships except one.

Their profits are taxed once as personal income c. It might even eliminate the downside of opportunity costs. Two heads or more are better than one.

A continuation of the firm if one partner dies ____. A Unlimited liability B Simplicity and ease of organization C Increased ability to obtain capital D Pooling of financial resources. All of the following are recognized as advantages of partnerships except A ease of formation.

One of the major disadvantages of a general partnership is the equal liability of each partner for losses and debts. All owners must be people no corporations d. High-calibre employees can be made partners.

D better access to capital and credit. The following are the advantages of partnership form of organisation. Their profits are taxed once as personal income c.

However time should be invested in developing the partnership agreement. No formal documents are required to be prepared as required in the case of joint stock companies. B partnerships avoid double taxation because the partnership itself is not subject to federal taxation.

All of the following are advantages of a general partnership except. Everything You Need to Know. Answered expert verified.

When deciding on a business type you may wonder about the advantages of a partnershipThere are various pros and cons to all business typesAs a result the preferred type you choose to start may vary depending on the needs of the specific business structure and the parties in question who hope to start the. A continuation of the firm if one partner. A horizontal merger a combines two or more firms involved in different stages of.

They are relatively easy to start B.

Advantages And Disadvantages Of Partnership Efinancemanagement

Advantages And Disadvantages Of Partnership Business What Is Partnership A Plus Topper

Comments

Post a Comment